Fascination About Clark Wealth Partners

Some Of Clark Wealth Partners

Table of ContentsClark Wealth Partners - QuestionsThe 10-Minute Rule for Clark Wealth PartnersThe Greatest Guide To Clark Wealth Partners7 Easy Facts About Clark Wealth Partners ExplainedSome Known Questions About Clark Wealth Partners.

Simply put, Financial Advisors can take on part of the obligation of rowing the boat that is your monetary future. A Financial Advisor need to deal with you, not for you. In doing so, they must function as a Fiduciary by putting the most effective rate of interests of their customers above their own and acting in great confidence while providing all appropriate truths and staying clear of problems of passion.Not all relationships are effective ones. Possible downsides of collaborating with a Financial Advisor consist of costs/fees, high quality, and prospective desertion. Disadvantages: Costs/Fees This can quickly be a favorable as long as it can be an adverse. The trick is to make certain you get what your spend for. The saying, "cost is an issue in the lack of value" is exact.

Genuinely, the objective must be to really feel like the advice and solution received are worth even more than the expenses of the partnership. If this is not the instance, after that it is a negative and thus time to reassess the relationship. Disadvantages: High Quality Not all Financial Advisors are equivalent. Equally as, not one consultant is ideal for every potential customer.

9 Easy Facts About Clark Wealth Partners Explained

A customer should always be able to answer "what happens if something happens to my Financial Advisor?". Always correctly veterinarian any type of Financial Expert you are contemplating functioning with.

when talking to consultants. If a certain area of expertise is needed, such as dealing with executive compensation strategies or establishing retired life plans for little business proprietors, locate consultants to interview that have experience in those fields. Once a connection starts, remain invested in the connection. Functioning with a Financial Consultant ought to be a collaboration - civilian retirement planning.

It is this kind of initiative, both at the begin and via the connection, which will aid accentuate the advantages and hopefully reduce the disadvantages. The role of a Monetary Advisor is to assist customers establish a strategy to meet the financial goals.

That task includes charges, sometimes in the kinds of possession administration charges, payments, intending charges, financial investment item costs, etc - Tax planning in ofallon il. It is essential to recognize all charges and the framework in which the advisor operates. This is both the duty of the expert and the client. The Financial Expert is accountable for offering worth for the costs.

The Buzz on Clark Wealth Partners

Preparation A company plan is essential to the success of your business. You require it to recognize where you're going, how you're arriving, and what to do if there are bumps in the road. A great financial advisor can create a thorough plan to assist you run your company extra successfully and get ready for anomalies that emerge.

Reduced Anxiety As a business proprietor, you have whole lots of things to fret around. A good monetary expert can bring you tranquility of mind understanding that your financial resources are getting the focus they need and your cash is being invested sensibly.

Sometimes company proprietors are so focused on the everyday grind that they lose view of the big photo, which is to make a revenue. An economic consultant will look at the overall state of your financial resources without getting emotions involved.

Clark Wealth Partners - The Facts

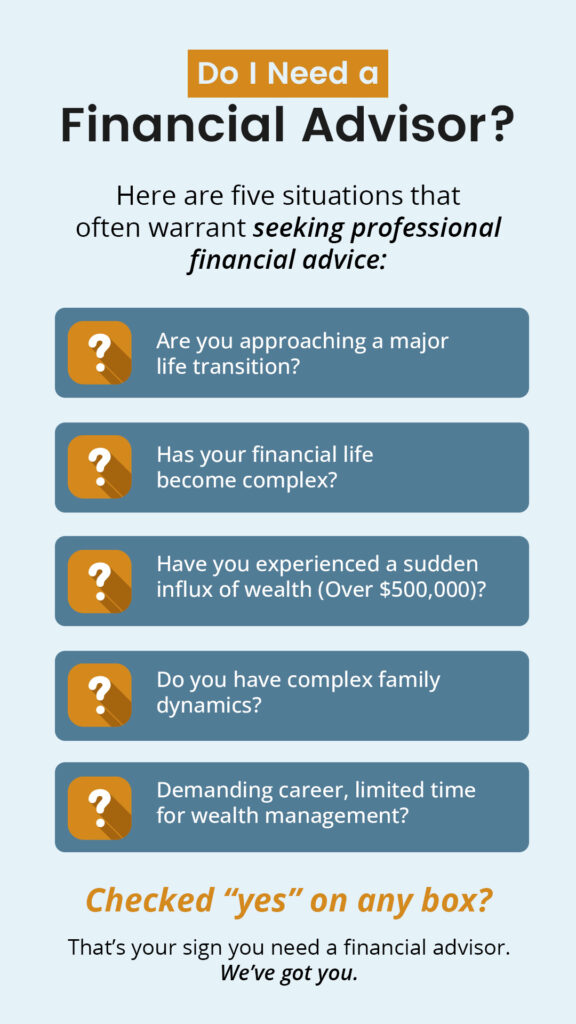

There are several advantages and disadvantages to think about when employing a financial expert. They can provide beneficial knowledge, particularly for complex financial planning. Advisors offer customized techniques customized to specific objectives, possibly leading to better financial end results. They can also alleviate the stress and anxiety of handling financial investments and economic decisions, giving satisfaction.

The expense of working with a monetary advisor can be significant, with fees that may affect total returns. Financial preparation can be frustrating. We advise talking with a financial consultant.

It just takes a few mins. Take a look at the experts' profiles, have an initial telephone call on the phone or intro personally, and pick that to deal with. Locate Your Consultant People transform to economic experts for a myriad of reasons. The possible advantages of hiring an advisor include the proficiency and knowledge they use, the individualized recommendations they can supply and the long-lasting discipline they can inject.

The Ultimate Guide To Clark Wealth Partners

Advisors learn specialists that remain upgraded on market patterns, financial investment techniques and economic regulations. This knowledge enables them to supply understandings that may not be conveniently noticeable to the average individual - https://sketchfab.com/clarkwealthpt. Their know-how can help you navigate intricate economic situations, make informed choices and potentially surpass what you would achieve on your own